In fact hedge funds are considered as the primary driver of growth in currency trading volumes. Twenty years ago there were only around a hundred hedge funds with about forty billion dollars in assets.

Live Capital Markets Trading For Hedge Funds

Live Capital Markets Trading For Hedge Funds

The currency market is considered to be.

Forex market hedge funds. Cht tokens are tradable fund units allowing you to monitor your investment live and liquidate according to your own investment strategy. Kristian kerr discusses his experience trading! for fx concepts previously one of the largest fx hedge funds in the world. The countinghouse crypto fund ico was concluded in june 2018.

Some hedge funds reduce the risk involved further by having equal long and short positions. Volatility is a core component in the forex market. The longshort strategy reduces market risk since the shorts offset the long market exposure.

Cht tokens can be acquired on several exchanges. Historically forex markets have been less appealing to hedge funds and proprietary trading groups as the number of instruments is small and not well suited to investors wanting diversified portfolios. However fast forward to the present day and pooled funds and hedge funds are now the second biggest players in the forex markets.

To form a hedge fund you will encounter many regulatory obstacles but their intent is to protect investors not block the path of an aspiring forex trader. The forex ma! rket is made up of banks commercial companies central banks in! vestment management firms hedge funds and retail forex brokers and investors. Acquire a share of the countinghouse crypto fund.

To give you an idea on how fast the hedge fund industry is growing here are some numbers. I have known for a long time that funds and other institutions that trade have much more info and reports on positions order books and similar stuff. We move with risk in mind to secure profit sustainably.

At last count some 10000 estimated hedge funds populate the planet with a subset of those devoted specifically to forex trading. This market neutral strategy not only involves lower risk but also offers lower returns. The concept of combining correlated positions in order to offset risk is where forex hedge funds originally got their name.

Bankhedge fund information recycle bin. If you are interested in trying to construct a market neutral strategy you can experiment risk free with our demo tr! ading account where you can trade with real information with virtual funds without putting your capital at risk.

Trusted Insight World S Biggest Hedge Funds Has Released A Video

Trusted Insight World S Biggest Hedge Funds Has Released A Video

Transaction Exposure Or Chapter 8 Ppt Video Online Download

Transaction Exposure Or Chapter 8 Ppt Video Online Download

Forex Trading

Forex Trading

Forex Hedge Funds London List Of London Hedge Funds Askivy

Who Are The Participants In The Forex Market Quora

Int! elvestor Cooperative Forex Partnership

Details About Bharat Hedge Fund Fx Strategy Forex Trading System For Mt4

Details About Bharat Hedge Fund Fx Strategy Forex Trading System For Mt4

Wealth Finance August 2016 By Ai Global Media Issuu

Wealth Finance August 2016 By Ai Global Media Issuu

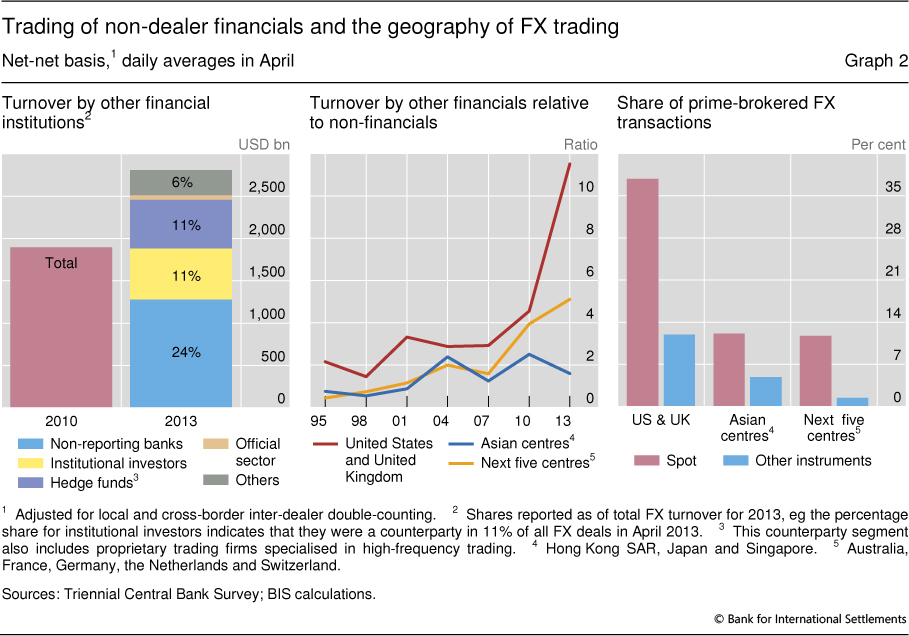

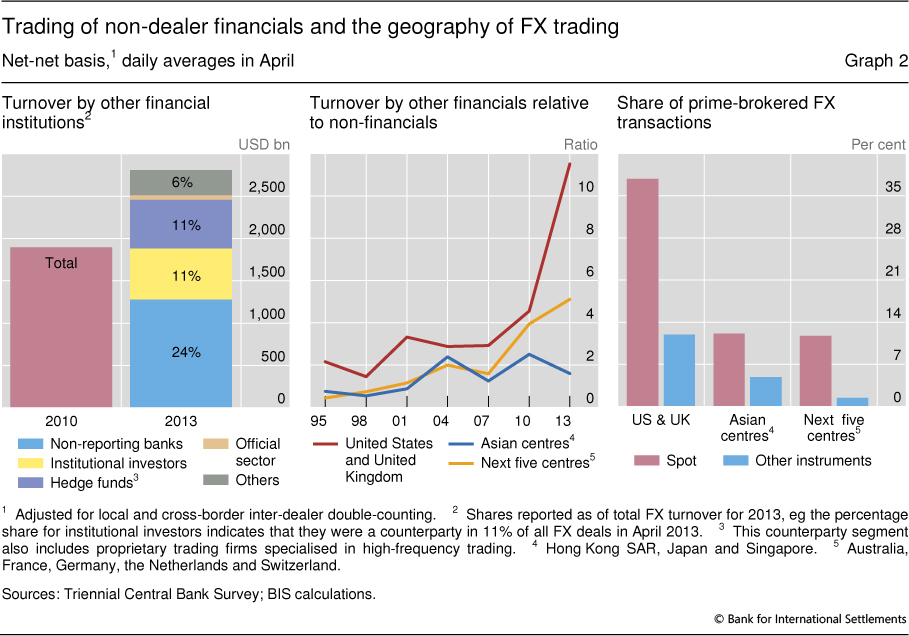

The Anatomy Of The Global Fx Market Through The Lens Of The 2013

The Anatomy Of The Global Fx Market Through The Lens Of The 2013

Forex Trading Strategy Session How To Trade Fx Like A Hedge Fund

Forex Trading Strategy Session How To Trade Fx Like A Hedge Fund

Forex Trading Strategies That Work Fxtp Signals

Forex Trading Strategies That Work Fxtp Signals

Her Er De Fem Storste Kryptovaluta Investeringsfonde

Her Er De Fem Storste Kryptovaluta Investeringsfonde

Forex Trading Strategy Hedge Fund Trader Jim Leitner Best Techniques

Forex Trading Strategy Hedge Fund Trader Jim Leitner Best Techniques

Fx Trading By Hedge Funds And Prop Traders Tumbles 30 Over Past

Forex Hedge Fund 2 En

Forex Hedge Fund 2 En

0 Response to "Forex Market Hedge Funds"

Posting Komentar